Below we summarize the changes in the VAT Act that are effective from 1 January 2025.

- The amendment to the law changes the VAT rates, which will be 23%, 19% and 5%.

- The rules for deducting VAT on the acquisition of goods from another Member State are amended

- Rules for reverse-charge on imports of goods

- Delivery location for virtual events is specified

- Limits for VAT registration are increasing

The rules for VAT deduction and corrections and adjustments to deducted VAT are amended

VAT rates

The amendment to the Act regulates VAT rates as follows:

- The standard VAT rate is increased to 23% (originally 20%).

- A reduced VAT of 19% is introduced for selected food, beverages, electricity and non-alcoholic beverages served in restaurants.

- A reduced VAT rate of 5% is introduced for accommodation services, books and e-books, medicines, restaurant meals and others.

- A precise list of goods and services with a reduced VAT rate can be found here and here.

- A reduced VAT rate of 19% shall be applied to goods in point 1 of Annex 7 to the VAT Act and services in point 1 of Annex 7a to the VAT Act, and

- The reduced VAT rate of 5% will be applied to other goods and services exhaustively defined in Annex No. 7 and 7a of the VAT Act.

- The reduced VAT rate of 10% is abolished.

- The new VAT rates will be applied to the supply of goods and services or upon receipt of pre-supply payment for which the tax liability arose before 1 January 2025.

Deduction of VAT on the acquisition of goods from another Member State

- A taxpayer may deduct VAT on the acquisition of goods from another Member State even without an invoice if the invoice is not available to the taxpayer until the relevant tax return is filed.

- Documents other than an invoice that prove the actual acquisition of goods are also admissible.

- Data from other documents are included in the control statement

Self-taxation on the import of goods (from 1.7.2025)

For taxpayers

- based in the Slovak Republic

- with effective Authorised Economic Operator (AEO) status

- AEO importers of goods into the country under centralized customs clearance (CCK)

the following rules apply:

- the obligation to pay import VAT to customs is abolished;

- the tax liability on import is fulfilled by filing a VAT return for the relevant tax period, where the tax deduction can also be claimed (no impact on cash-flow)

Delivery of goods under financial leasing

In the case of contracts concluded after 1 January 2025 with the option to purchase the goods by the lessee by paying the last installment, if the purchase is economically the only rational choice for the lessee at the time of conclusion, it will be a supply of goods for which it is necessary to pay VAT on the entire value of the goods at the beginning of the financial lease when they are handed over.

Delivery Location for Virtual Events

The place of supply of cultural, artistic, sporting, scientific, educational, entertainment and similar services, such as services at exhibitions and fairs, including their organisation and related ancillary services, and entry to those events, when they are broadcast or otherwise made available virtually, the place of supply of those services, including related ancillary services, and virtual access to those events

- supplied to the taxable person, it will be a general B2B service,

- supplied to a non-taxable person is the place where a person other than the taxable person has his registered office, domicile or habitual residence.

Other invoicing changes

A simplified invoice (receipt from an e-cash register or for refueling) can only be issued for the supply of goods or services, the price of which including VAT is not more than 400 euros (originally 1000 euros for cash payments and 1600 euros for non-cash payments).

If the payer has applied for VAT registration in time and does not have a VAT number by the deadline for issuing the invoice, he will issue an invoice within 5 working days after receiving the VAT number. He will also file a VAT return and a control statement within the same deadline if he does not have a VAT number by the deadline for filing.

Other changes

VAT deduction on registration can only be made in the first tax period.

A taxpayer who applied for registration late must file a VAT return and a control statement for each period from which he should have been a payer separately in chronological order. The above also applies to zero VAT returns. This excludes one VAT return.

New limits for VAT registration of a domestic taxable person § 4

A domestic taxable person becomes a taxpayer (only changes compared to the original regulation):

- On the first day of the calendar year following the calendar year in respect of which the value, exclusive of tax, of the goods or services supplied by that person, which are included in the turnover, exceeded EUR 50 000.

- By supplying goods or services with a tax-free value of goods or services supplied by that person, which are included in turnover, exceeds EUR 62,500 in the current calendar year.

- the effective date of the conversion in the event of a spin-off or the effective date of the conversion in the event of a spin-off in accordance with the law in force in another Member State or a Contracting State of the EEC, or the date of effectiveness of the conversion in the event of a cross-border spin-off, if tangible assets or intangible assets of the payer that have been divided by spin-off or cross-border spin-off are transferred to that person in the national territory. When applying for registration, it is also necessary to submit documents certifying this fact.

The application for VAT registration is submitted within 5 working days. The tax administrator will assign the VAT number to the registration no later than 10 days after receiving the VAT application. The VAT number will be valid retroactively from the day when the taxable person became a payer.

VAT registration of a foreign person § 5

A foreign taxable person becomes a taxpayer (only changes compared to the original regulation) to whom tangible assets or intangible assets of the payer are transferred in the Slovak Republic, which:

- ceased to exist without liquidation, on the day on which it became the legal successor of the payer, if it continues to meet the status of a foreign person,

- has been divided by spin-off, on the effective date of the conversion in the event of a spin-off under the law in force in another Member State or a Contracting State of the EEC, if it continues to fulfil the status of a foreign person, or

- has been divided by cross-border spin-off, namely on the effective date of the conversion in the case of a cross-border spin-off, if it continues to meet the status of a foreign person.

The application for VAT registration is submitted within 5 working days. When applying for registration, it is also necessary to submit documents certifying this fact.

The tax administrator will assign the VAT number to the registration no later than 10 days after receiving the VAT application. The VAT number will be valid retroactively from the day when the taxable person became a payer.

Special scheme for small businesses

A small business of a domestic person when supplying goods and services to another Member State is obliged to register for VAT if the turnover exceeds EUR 100,000 in the EU in two consecutive years.

A small business of a foreign person when supplying goods and services in the Slovak Republic is obliged to register for VAT if the turnover of the local turnover in the Slovak Republic and the EU turnover in the amount of EUR 100,000 is exceeded.

Rules for the application of the special scheme for small and medium-sized enterprises

- Registration for this specific scheme; Assigning an "EX" VAT ID

- Filing a report on a quarterly basis electronically

- At the moment of a breach of the terms and conditions, the obligation to notify the DS

Correction and adjustment of the deduction

The amendment regulates the obligation (or right) to correct and adjust the deducted tax, which has so far not sufficiently reflected the EU VAT Directive. The terms primary use and fixed assets are defined as:

- Primary use is the first real use of goods and services for activities giving rise to the right of deduction.

- Fixed assets are assets used for business that are not intended for resale and have a useful life of more than one year.

The deducted tax for fixed assets may be adjusted for a period of 5 years from the initial use for movable property with a purchase price of more than EUR 1,700 (for tangible fixed assets) or over EUR 2,400 (for intangible fixed assets) and a useful life of more than 1 year, and within a period of 20 years from the initial use for buildings, building land, apartments, non-residential premises, superstructures and extensions requiring a building permit.

The taxpayer is obliged to correct the deducted tax if he has claimed a tax deduction,

- in the case of complete or partial cancellation of the supply of goods or services and in the case of full or partial return of the supply of goods, in the case of a decrease in the price of goods or services after the tax has arisen, in the case of an increase in the price of goods or services, as a result of which the tax base has decreased,

- in the case of a tax deduction in a higher amount than it could have made on the basis of the initial use,

The taxpayer has the right to correct the deducted tax if he has claimed a tax deduction

- in the case of complete or partial cancellation of the supply of goods or services and in the case of full or partial return of the supply of goods, in the case of a decrease in the price of goods or services after the tax has arisen, in the event of an increase in the price of goods or services, as a result of which the tax base has increased,

- deduction of tax in a lower amount than he could have made on the basis of the initial use.

As a result of the amendment, there is an obligation to verify the actual use of goods and services against the declared primary use, and to correct the deducted tax based on the changes.

If goods whose tax has been deducted in whole or in part are stolen, the taxpayer pays tax in the amount of the deduction. If the taxpayer gets the goods back, he has the right to correct the deducted tax.

Adjustment of the deduction of tax for fixed assets

The amendment defines fixed assets as the payer's fixed assets, which are movable assets with a separate technical-economic purpose with a purchase price of more than EUR 1,700, buildings, building land, apartments and non-residential premises, superstructures of buildings, extensions to buildings and building modifications requiring a building permit, and intangible assets with a purchase price of more than EUR 2,400.

The taxpayer is obliged to adjust the deducted tax if he changes the purpose of use of the fixed assets or their scope and the deducted tax at the initial use was higher than it could have been deducted.

The taxpayer has the right to adjust the deducted tax if he changes the purpose of use of the fixed capital goods or their scope and the tax deducted at the initial use was lower than it could have been deducted.

The taxpayer is obliged to keep detailed records of the purposes of the use of fixed assets for business and their scope.

Procedure for adjusting the deduction of capital goods

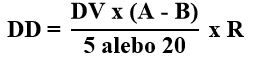

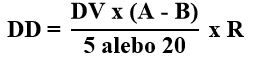

The tax deducted is adjusted according to the following formula:

where

DD is the result of the adjustment of the deducted tax,

DV is the tax applicable to the purchase price,

A is the proportion expressing the amount of tax deducted by the taxpayer on the capital goods at the time of their initial use, to the amount of tax relating to the purchase price or the own costs of the fixed assets,

B is the proportion expressing the amount of tax that the taxpayer can deduct in respect of capital goods in relation to the amount of tax relating to the purchase price or own costs of fixed assets,

R is the number of calendar years remaining until the end of the period for adjusting the tax deduction.

Changes to the free of charge delivery of goods

If the payer supplies goods for his personal consumption, supplies goods for the personal consumption of his employees, supplies goods free of charge or supplies goods for a purpose other than business, the tax base is the purchase price of the goods in question at the time of their delivery or, if such purchase price cannot be ascertained, the purchase price of similar goods at the time of their supply; If there is no purchase price, the tax base is the cost of creating those goods at the time of delivery.